The energy landscape has undergone significant changes over the past decade, particularly with the rise of natural gas as a preferred fuel source for electricity generation. Stricter air pollution standards, the advent of more efficient natural gas power plants, and advancements in natural gas drilling methods, such as fracking, have all contributed to its prominence.

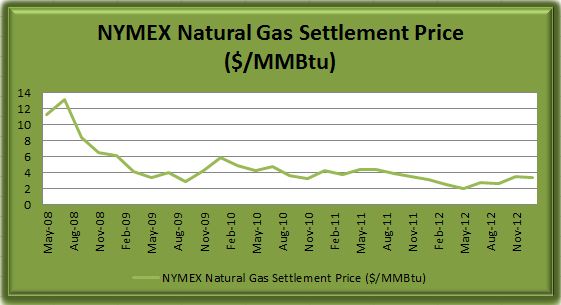

However, the volatility of natural gas prices, often traded on short-term spot markets, poses a significant risk to electricity costs, which are closely tied to these natural gas prices. With the historic spike to around $13/MMBtu in 2008 and the subsequent drop to record lows, the unpredictable nature of natural gas pricing remains a crucial consideration for businesses nationwide.

Since then, natural gas prices have fallen to new record lows.

Natural Gas Prices

The Fluctuation of Natural Gas Prices and Its Implications

Companies in competitive energy markets have seen this volatility as a double-edged sword. The decrease in natural gas prices presented an opportunity to hedge electric and natural gas costs, securing contracts at low prices.

Yet, the ever-present potential for regulatory changes, shifts in supply and demand, and market fluctuations means prices could escalate without warning. This unpredictable market underscores the importance of managing risks associated with electricity costs – an essential expenditure for most businesses.

Capacity Markets

The Critical Role of Capacity Markets in Energy Pricing

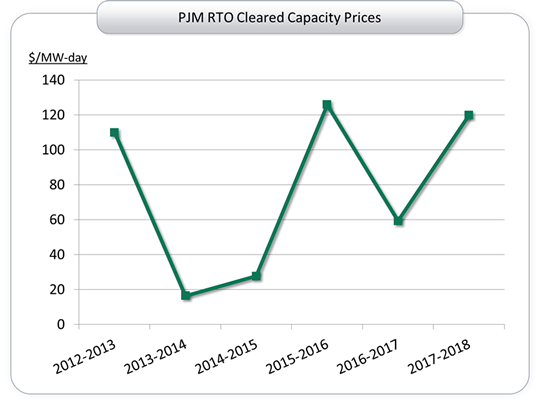

Understanding the cost of energy is incomplete without considering the impact of capacity markets, especially in regions served by the PJM Interconnection. States like Pennsylvania, New Jersey, Massachusetts (ISO-NE), Ohio, Illinois (ComEd) and Maryland are all part of the PJM RTO (Regional Transmission Organization), and PJM is what is referred to as a “Capacity Market.” More specifically, PJM calls its market the Reliability Pricing Model (RPM) because any capacity market’s purpose is to ensure there is enough juice to meet demand—and then a little more (reserve margin).

Capacity costs are incurred to ensure that the power generation capacity is sufficient to meet future demand, which includes a reserve margin. These costs are determined through a competitive auction system and are reflected in the energy bills of consumers within these markets.

NOTE: The purpose of this post is purely educational and meant to help readers understand the basic concept of capacity in energy markets and how it factors into their power cost. The argument for or against a capacity market is complicated at best—political and ideological at worst.

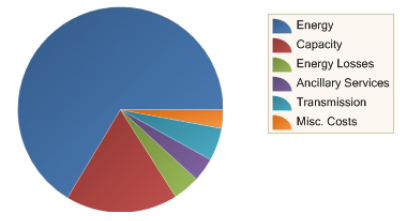

How Capacity Affects Your Energy Bill

Consumers in capacity markets like those in the Northeast and Midwest have recently seen rate increases due to the workings of the PJM's Reliability Pricing Model (RPM). This model is designed to guarantee enough energy supply for the future. As regulations tighten and older, less expensive generation resources retire or undergo costly retrofits to meet EPA air quality standards, newer, more expensive generation sources are stepping in to fill the gap – leading to higher costs for consumers.

Cost Impact of Capacity Market Dynamics

All bids within capacity markets are based on the resource's total cost of operation. Consequently, generation sources that have recouped their initial capital investments often have the flexibility to offer their capacity at reduced prices. However, recent trends, as illustrated in Figure 2, have shown that these older, typically less costly generation resources are being phased out or are facing increased operational costs due to retrofits mandated by stricter EPA air quality regulations. This shift necessitates the introduction of newer, generally more expensive generation sources to fill the void.

Figure 1: Capacity makes up a significant part of your overall energy cost.

Figure 2: Capacity Costs Have Risen Sharply in Recent Years

For consumers participating in capacity markets, the impact of these changes is directly observable in their energy bills, which now reflect the higher cost of maintaining a reliable electricity supply.

The Importance Of An Energy Consultant

Navigating Market Complexities with Expert Guidance

Given the complexities of both natural gas and capacity markets, businesses must navigate these waters with a strategic approach. This is where the value of an energy consultant becomes apparent. With expertise in market trends, regulatory changes, and risk management, an energy consultant can guide you in locking in favorable rates and developing robust energy management strategies that align with your business needs.

Why an Energy Consultant is Essential

Amidst fluctuating natural gas prices and the intricacies of capacity markets, the need for specialized guidance has never been more critical. An energy consultant doesn't just offer advice; they provide a pathway to maximize opportunities in a landscape where energy costs can fluctuate significantly. As companies look to safeguard their interests and stabilize their energy expenses, the role of an experienced energy consultant becomes an indispensable asset in the pursuit of economic efficiency and energy cost management.